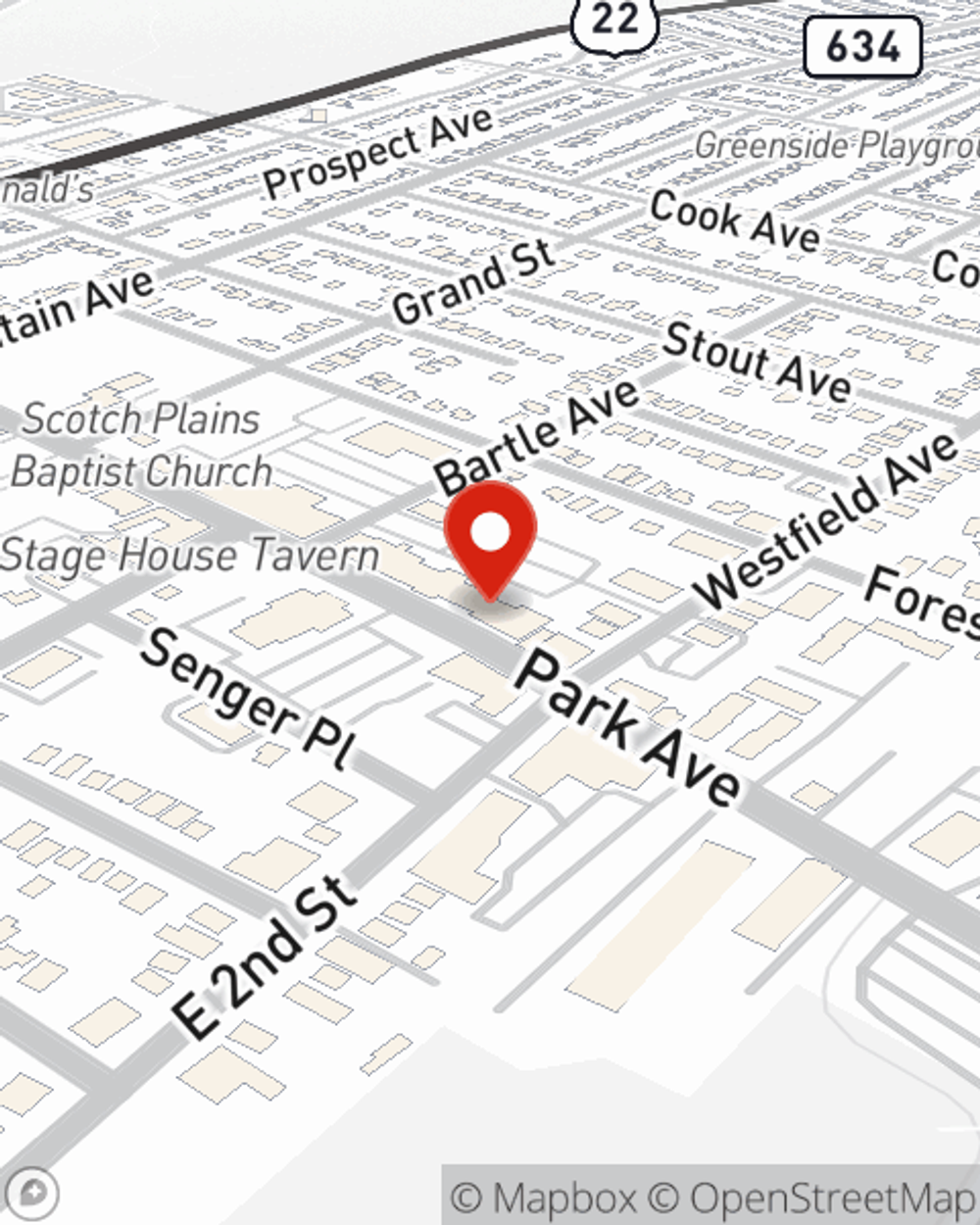

Renters Insurance in and around Scotch Plains

Looking for renters insurance in Scotch Plains?

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

- Scotch Plains

- Fanwood

- Westfield

- Plainfield

Home Is Where Your Heart Is

It may feel like a lot to think through work, your busy schedule, your sand volleyball league, as well as coverage options and savings options for renters insurance. State Farm offers no-nonsense assistance and impressive coverage for your clothing, mementos and furniture in your rented space. When mishaps occur, State Farm can help.

Looking for renters insurance in Scotch Plains?

Renting a home? Insure what you own.

Open The Door To Renters Insurance With State Farm

Renters insurance may seem like last on your list of priorities, and you're wondering if it can actually help you. But pause for a minute to think about what would happen if you had to replace all the stuff in your rented property. State Farm's Renters insurance can help when thefts or accidents damage your personal property.

State Farm is a dependable provider of renters insurance in your neighborhood, Scotch Plains. Contact agent Jason Bartlett today and see how you can save!

Have More Questions About Renters Insurance?

Call Jason at (908) 322-4373 or visit our FAQ page.

Simple Insights®

How to create a home inventory

How to create a home inventory

A home inventory can be a way to help make home or renters insurance coverage decisions & expedite the insurance claims process after theft, damage or loss.

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Jason Bartlett

State Farm® Insurance AgentSimple Insights®

How to create a home inventory

How to create a home inventory

A home inventory can be a way to help make home or renters insurance coverage decisions & expedite the insurance claims process after theft, damage or loss.

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.